are 529 contributions tax deductible in oregon

No matter how you file Block has your back. For example in addition to contributing to your IRA and HSA you may have access to a.

What S A 529 Plan Can I Offer A 529 Plan As An Employee Benefit Ask Gusto

This comprehensive 529 plan comparison tool lets you compare over 40 features including investment options state income tax benefits and more.

. Reduce your accounting overhead costs by as much as half - our system eliminates the need for bookkeepers and accountants on staff often at half the cost. Are 529 contributions considered tax deductible. Except in the case of rollover contributions described in section 223f5 or trustee-to-trustee transfers the trustee or custodian may not accept annual contributions to any HSA that exceed the sum of.

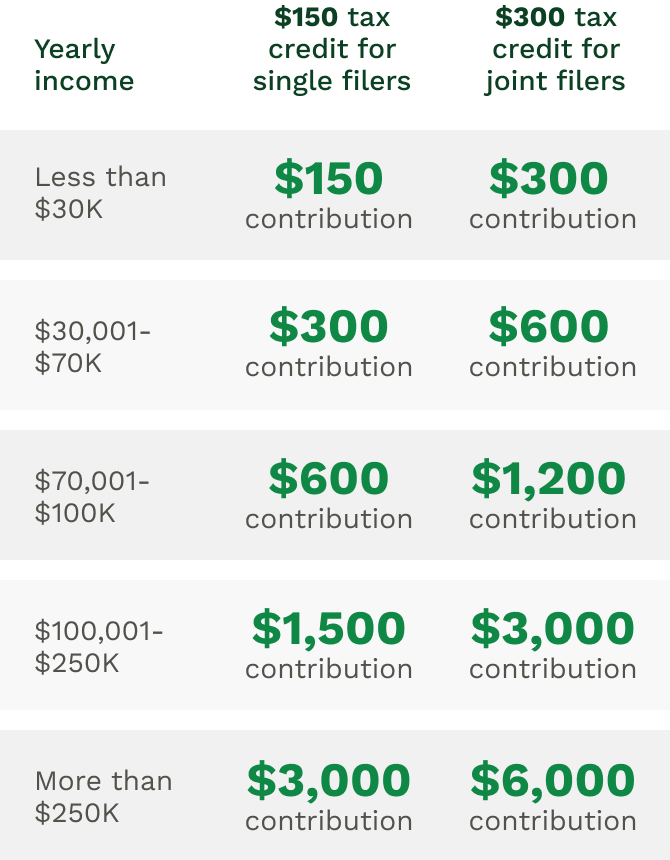

Oregon gives a tax credit for 529 contributions. The credit is up to 300 for joint filers and up to 150 for individuals. The total amount that can be contributed to any beneficiarys ABLE account in 2018 is 15000.

In 2019 individual taxpayers were allowed to deduct up to 2435 for contributions made to the Oregon College Savings Plan while those filing jointly could deduct 4865. Taxpayers can deduct contributions made via CollegeInvest 529 college savings plans. For 79 or just 152 per week join more than 1 million members and dont miss their upcoming stock picks.

The investment options are different in each plan. Much greater annual contributions are permitted for 529 accounts and they are not limited to individuals whose. Families may also enjoy a state income tax deduction or credit for 529 plan contributions depending on where they live.

To easily compare 529 plan fees and performance try the 529 Consumer Comparison Tool. In looking beyond the 2021 tax year you may want to consider other ways to make tax- smart contributions. Learn more from the tax experts at HR Block.

When you set up a 529 plan account for a child you first have to decide. The deduction was allowed for contributions to an Oregon 529 plan of up to 2435 by an individual and up to 4865 by a married couple filing jointly in computing Oregon taxable income with a four-year carry forward of excess contributions. Married couples can deduct up to 30000 per beneficiary per year as long as each.

Full Site Disclaimers. Pennsylvania allows deductions of up to 15000 per beneficiary per year for single filers. The new law part of the major tax cut legislation of 2017 does permit limited transfers from 529 accounts into ABLE accounts.

Motley Fool Stock Advisor recommendations have an average return of 618. A In generalThere is hereby imposed on the income of every individual a tax equal to the sum of 1 12 PERCENT BRACKET12 percent of so much of the taxable income as does not exceed the 25-percent bracket threshold amount 2 25 PERCENT BRACKET25 percent of so much of the taxable income as exceeds the 25-percent bracket threshold amount but does not. File with a tax pro File online.

Some states have multiple plans. 1 the dollar amount in effect under section 223b2Bii ie the maximum family coverage deductible plus 2 the dollar amount in effect under section. Every state has a plan.

For account owners taking advantage or planning to take advantage of the carry forward this option remains available for contributions. Although contributions to a 529 plan arent deductible for federal income tax the earnings are tax free when you take the money out for college expenses. In states where eligible 529 plan contributions are deductible on participants state income tax returns the home-state plan is often the soundest financial choice.

Dedicated to keeping our tax preparation skills honed with continuing education courses throughout the year we are highly qualified to prepare tax returns for all fifty states. Qualified higher-education expenses are essential costs related to the enrollment or attendance of an eligible educational institution. A 529 account transfer eats into that limit.

This includes tuition qualified education programs fees for enrollment books and supplies. Learn More Accounting Bookkeeping. Offer Details and Disclosures.

The taxpayer making the contribution does not have to be related to the owner or beneficiary of the plan. In the past contributions to the Oregon 529 Plan were deductible on your Oregon state income tax return up to certain limits. HR Block Online Deluxe or Premium or HR Block Software Basic Deluxe Premium or Premium Business get unlimited sessions of live personal tax.

529 plans are sponsored by the states.

How Do I Choose A 529 Morningstar 529 College Savings Plan Saving For College How To Plan

529 Plans Which States Reward College Savers Adviser Investments

How Much Is Your State S 529 Plan Tax Deduction Really Worth

529 Tax Deductions By State 2022 Rules On Tax Benefits

Are 529 Plans A Good Way To Pay For College Springwater Wealth Management

529 Tax Benefits By State Invesco Invesco Us

Oversaving In A 529 Is A Much Smaller Problem Than You Would Think R Financialindependence

529 Plans Which States Reward College Savers Adviser Investments

10 Things Parents Should Know About College Savings

Can I Use A 529 Plan For K 12 Expenses Edchoice

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

Oregon 529 Plans Learn The Basics Get 30 Free For College Savings

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

Does Your State Offer A 529 Plan Contribution Tax Deduction

Tax Benefits Oregon College Savings Plan

529 Plans Which States Reward College Savers Adviser Investments

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar State Tax College Savings Plans 529 College Savings Plan